US Crypto Startups Dominate VC Funding In Q4: Is More To Come?

Source: Bitcoinist

Latest report from Galaxy Digital’s Crypto and Blockchain Venture Capital has revealed some interesting trend recorded in the crypto market last year especially concerning the VC sector.

According to the report, in the fourth quarter of 2024, nearly half of all venture capital funding in the cryptocurrency and blockchain sector was directed toward startups based in the United States.

Additionally, 46% of the total invested capital flowed to US-based startups. This figure far exceeded the share received by other jurisdictions, with Hong Kong coming in second at 16% and Singapore and the UK following behind.

Early and Late-Stage Funding Trends

Assessing the report further, it reveals that the US also led in deal volume, accounting for 36% of all venture capital deals during the quarter. Despite the ongoing regulatory uncertainty and pressures within the US, the country’s dominance in attracting both capital and deal activity was evident.

Galaxy head of research Alex Thorn in a post on X pointed out that the favorable outlook for the sector, combined with the possibility of a pro-crypto administration taking office, may further strengthen the US’s position in the global digital currency venture capital landscape.

Meanwhile, Venture capital activity in Q4 2024 revealed a continued appetite for both early and late-stage digital currency startups. Approximately 60% of the capital raised went to early-stage companies, highlighting sustained interest in new and innovative blockchain projects.

The remaining 40% was directed toward later-stage companies, driven in part by significant deals such as Cantor’s $600 million investment in Tether.

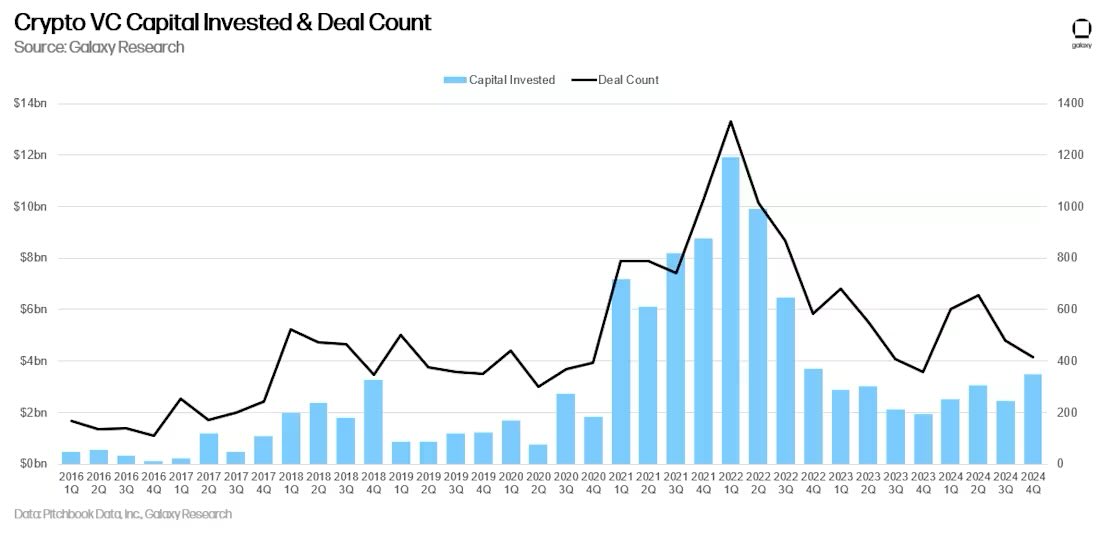

The data also showed that median deal sizes increased over the year, reflecting a trend seen across the broader venture capital market. While the number of deals declined slightly, the overall dollar amount invested reached $3.5 billion for the quarter, a 46% increase quarter-over-quarter.

However, despite the increase in funding levels, crypto venture funds themselves faced challenges, with just $1 billion allocated across 20 new funds—close to quarterly lows seen as far back as early 2021.

The Road Ahead for US Crypto Startups

As the US solidifies its status as the top destination for digital currency venture funding, industry observers are looking to 2025 for further growth.

The election of a more crypto-friendly administration could help address regulatory uncertainties, paving the way for even greater investment in the sector. In addition, the strong activity in early-stage deals signals that entrepreneurs with fresh ideas are still able to secure funding, ensuring a steady pipeline of innovation.

Looking beyond the US, the report highlighted key themes in the global crypto venture market, including the rise of Web3 projects, decentralized finance (DeFi), and blockchain infrastructure.

These sectors led in terms of capital allocation, indicating where investors see the most promise for growth. As the market matures, these areas are expected to drive further capital flows and shape the future of the crypto ecosystem.

Featured image created with DALL-E, Chart from TradingView