Bitcoin Sentiment Drops To Pre-Rally Levels As Traders Turn Bearish Post-ATH | TheSpuzz

Source: Bitcoinist

Bitcoin and US equities are facing mounting pressure as macroeconomic uncertainty and erratic policy decisions from US President Donald Trump continue to shake investor confidence. With unexpected tariff announcements and unstable foreign policy stances dominating headlines, markets have become increasingly volatile. Bitcoin, often seen as a hedge against traditional market instability, has entered a consolidation phase around the $85,000 level. After weeks of sharp price swings, BTC appears to be gathering momentum for its next major move—up or down.

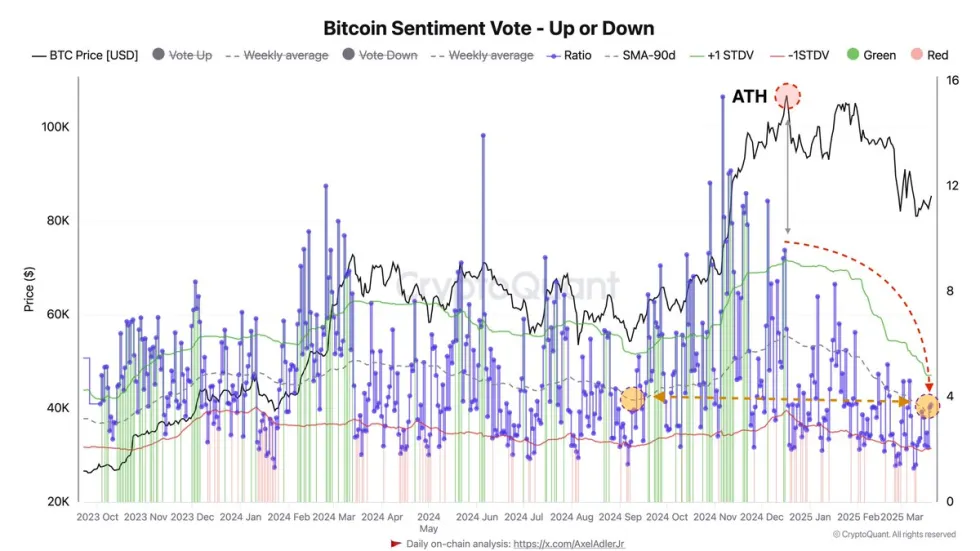

Despite hopes for a strong recovery following its all-time high earlier this year, sentiment across the crypto space has grown increasingly bearish. According to new data from CryptoQuant, investor and trader outlook on Bitcoin has shifted significantly. The Bitcoin Sentiment Vote – Up or Down chart reveals a clear transition toward negative sentiment, with a majority now betting against further short-term gains. This trend mirrors conditions last seen in September 2024, just before the market’s last major rally.

With sentiment turning sour and price action narrowing, Bitcoin’s current position at $85K has become a battleground for bulls and bears. Whether this period of indecision resolves in a breakout or breakdown may depend heavily on broader economic developments and investor reaction to continued political instability.

Investor Sentiment Hits 6-Month Low As Bitcoin Stalls Below $90K

Investors face a crucial moment as Bitcoin trades in a tight range, struggling to reclaim key resistance levels while holding above critical support. Despite attempts to initiate a recovery, bulls have been unable to generate enough momentum to push prices meaningfully higher, while bears have failed to force a decisive breakdown. This ongoing stalemate has heightened market tension.

The failure to reclaim the $90K level and hold above $85K consistently has led some analysts to question whether the current cycle is still intact. The pressure on bulls to prove the continuation of the bull run is mounting, as sentiment begins to shift toward a more cautious—or even bearish—outlook.

Top analyst Axel Adler shared insights on X that paint a sobering picture. According to Adler, after Bitcoin reached its ATH, sentiment took a sharp turn for the worse. This shift is clearly illustrated in the Bitcoin Sentiment Vote – Up or Down chart. The current quarterly sentiment ratio has dropped to levels not seen since September 2024, just before the market’s last major rally.

While it’s possible that this bearish sentiment could serve as a contrarian indicator—signaling a bottom—many believe it reflects deeper uncertainty. With macroeconomic instability and geopolitical concerns on the rise, Bitcoin’s next move will be crucial in determining whether the broader market sees a renewed uptrend or enters a prolonged bearish phase. As traders watch the $85K–$90K zone closely, the coming days may be decisive for BTC’s trajectory in 2024.

Bulls Face Growing Pressure

Bitcoin is currently trading at $84,200, holding just below the critical $85,000 level where both the 200-day moving average (MA) and exponential moving average (EMA) converge. This area has become a significant resistance zone, and bulls have struggled to push past it. To initiate a strong recovery rally, BTC must break above the $88,000 level—this would confirm momentum and could trigger a swift move back toward the psychological $90,000 mark.

For now, price action remains range-bound and uncertain, with bearish sentiment still weighing on the market. While BTC has managed to hold above short-term support at $82,000, the inability to reclaim the 200-day MA/EMA cluster raises concerns about further downside pressure.

If bulls fail to defend current demand and the price drops below $82,000, a retest of the $81,000 level is likely. Losing that support could open the door for a deeper correction toward the $78,000–$75,000 range. This scenario would further shake investor confidence and reinforce the growing narrative that the market is transitioning into a longer consolidation or bearish phase.

The coming days are critical, and all eyes remain on BTC’s ability to flip $85K into support and target higher resistance zones.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.