Bitcoin Eyes $65,000 For Bullish Breakout – Metrics Reveal High Liquidity Above This Level | TheSpuzz

Source: Bitcoinist

Bitcoin has experienced a significant 11% price surge since Tuesday, following the Federal Reserve’s announcement of a 50 bps interest rate cut. This news boosted investor confidence, pushing BTC past the $60,000 mark—an important psychological level that shifted market sentiment. Now, BTC is testing local supply levels, with analysts closely watching the next moves.

As the market rises, crucial data suggests that Bitcoin liquidity is concentrated above the $65,000 mark, with a key zone around $70,000. This level is becoming the focal point for traders and investors eager to confirm the start of a stronger uptrend. Breaking past these supply levels would indicate further momentum for BTC, signaling the potential for new all-time highs.

With the market pushing upward, investors are waiting for a decisive close above these critical price levels to confirm the bullish trend. If achieved, it could set the stage for a sustained rally, bringing Bitcoin closer to its next major targets.

Bitcoin Liquidity Resting Above $65,000

Bitcoin is trading at a crucial supply level, but many investors believe it’s only a matter of days before BTC challenges local highs of around $65,000.

Key data from Coinglass reveals significant liquidity levels just above $65,000, with a strong concentration around the $70,000 mark. According to the Coinglass liquidation heatmap, billions of dollars of positions are at risk of liquidation at these levels. This presents an important opportunity for traders, as liquidations often drive sharp price movements.

The liquidation heatmap calculates liquidation levels based on market data and various leverage amounts. These levels are then overlaid on the price chart, helping traders visualize where potential liquidations may occur.

Understanding where these liquidation clusters are can provide a strategic advantage, similar to reading high liquidity areas in the order book. Traders who can anticipate where large liquidations might occur can position themselves to capitalize on the subsequent price volatility.

Coinglass’s heatmap data suggests that Bitcoin will likely target these supply levels to trigger liquidity. As a result, many traders expect BTC to continue pushing higher, with $70,000 emerging as a key target. Should Bitcoin reach this level, it could further fuel bullish sentiment and drive momentum toward new all-time highs.

BTC Price Levels To Watch

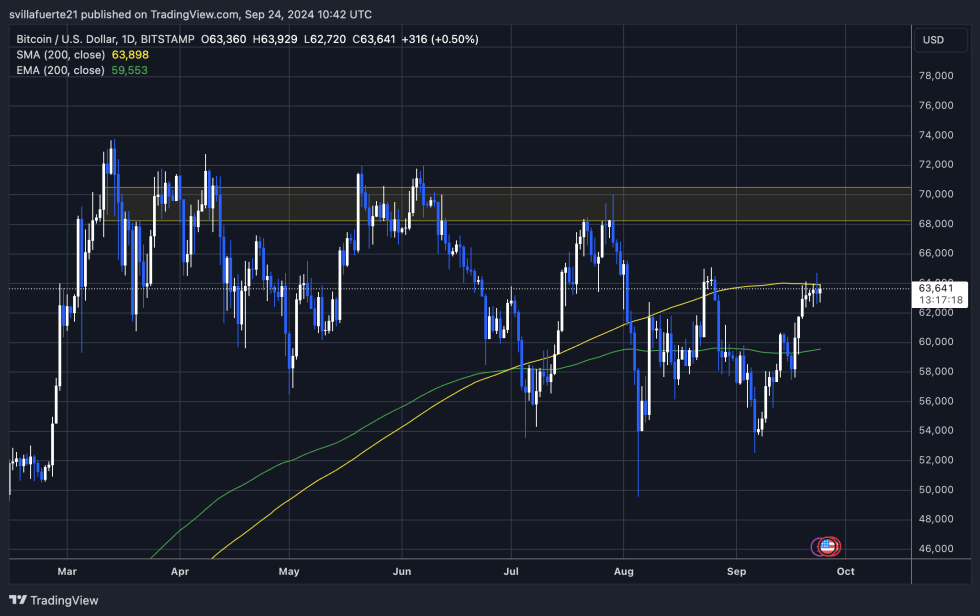

Bitcoin trades at $63,641 after several days of consolidation, just below the daily 200 moving average (MA) of $63,898. This key indicator represents long-term strength, and BTC has struggled to break above it.

Despite this, Bitcoin hasn’t dropped to lower levels, signaling that a breakout may be imminent. Many investors believe it’s only a matter of days before BTC reclaims the 200 MA and the $65,000 mark, which could fuel further upside momentum.

Bulls are growing more optimistic, especially with the recent shift in market sentiment following the Federal Reserve’s announcement of interest rate cuts. This has injected fresh energy into the market, making a potential Bitcoin rally more likely. However, caution remains, as there’s still a chance that Bitcoin could test lower demand levels around $60,000 before pushing higher.

If BTC fails to close above the daily 200 MA soon, this scenario becomes increasingly probable, with a dip to $60,000 offering another buying opportunity before the next leg upward. Traders are closely watching for a decisive move in either direction to gauge the market’s next steps.

Featured image from Dall-E, chart from TradingView