Hong Kong Crypto Growth Tops Eastern Asia – How Did It Outpace The region?

Source: Bitcoinist

Hong Kong’s 86% year-over-year crypto transaction growth is impressive. Chainalysis reports that Hong Kong leads Eastern Asia in crypto adoption following this rise. The region ranks 30th in digital currency adoption internationally, indicating its potential as a major player.

Factors Fueling The Growth

Several factors drive this phenomenal increase. The regulatory environment of Hong Kong is unique. For example, Hong Kong has adopted a more benign attitude toward cryptocurrencies than mainland China, where high regulations have been implemented.

This adaptability fosters financial innovation and attracts the attention of institutional and individual investors who wish to enhance their cryptocurrency portfolios.

Source: Chainalysis

The total value received at the market place is dominated by centralized exchanges, which hold about 64% of the total value received in Eastern Asia. This pattern indicates that investors use those centralized platforms to fulfill their trading needs.

The crypto landscape is divided deep down in Eastern Asia. CEXs remain the favorite, holding a whopping 65% of the value on the market. The convenience and reliability of these platforms sway retail traders to them, but beneath such an underhanded truth is playing itself out – more institutional players are moving away from these centralized hubs.

As of today, the market cap of cryptocurrencies stood at $2.01 trillion. Chart: TradingView.com

Decentralized exchanges (DEXes) and decentralized finance platforms are becoming increasingly popular among institutional investors, despite the fact that regular traders prefer centralized exchanges. This change shows that larger participants are looking for various investment methods that can take advantage of market inefficiencies, which are typically the case in decentralized marketplaces.

Eastern Asia Crypto Landscape

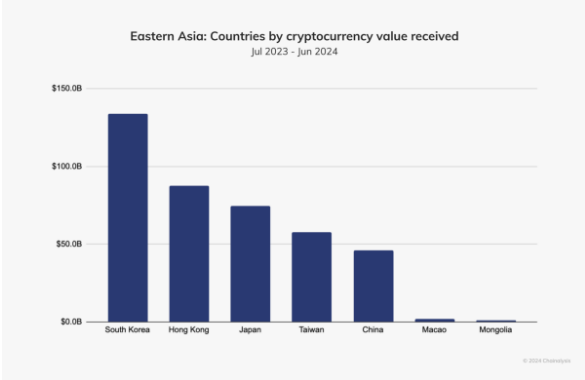

In Eastern Asia, there has been a substantial increase in the use of cryptocurrencies in recent years. The region accounted for roughly 9% of the total value of cryptocurrency transactions between July 2023 and June 2024. There were over $400 billion in transactions executed on the blockchain during this time.

Source: Chainalysis

South Korea keeps the top spot in the Eastern Asia region in terms of cryptocurrency value received, at approximately $130 billion during the time period studied.

While Hong Kong has grown rapidly, there are still significant challenges for the near future. Approval of Ether ETFs from the US Securities and Exchange Commission recently has breached some of the competitive advantages Hong Kong had over other global destinations for cryptocurrencies.

Crypto investments will attract more attention from other financial centers, and Hong Kong will have to keep innovating to remain on the radar of the top digital currency destinations.

The Road Ahead

Though they are promising, prospects for cryptocurrencies in Hong Kong are yet unknown. Although cementing its dominance in Eastern Asia, the area had to negotiate shifting policies both domestically and offshore. Investors are eagerly watching the finance district’s response as well as whether it can maintain its solid rate of growth.

A supportive control environment and increasing institutional interest in and around the area have helped to enable even further development. New problems from domestic policy and foreign competition, however, will necessitate innovative ideas and more legal clarity if the city is to keep its edge.

Featured image from Hong Kong Tourism Board, chart from TradingView